Fascination About Guided Wealth Management

Table of ContentsGuided Wealth Management Can Be Fun For AnyoneThe 5-Second Trick For Guided Wealth ManagementHow Guided Wealth Management can Save You Time, Stress, and Money.The Best Guide To Guided Wealth ManagementFacts About Guided Wealth Management UncoveredThe Definitive Guide for Guided Wealth Management

Selecting a reliable economic advisor is utmost crucial. Do your research study and hang out to evaluate prospective financial experts. It is appropriate to place a large initiative in this process. Perform an exam amongst the prospects and choose the most certified one. Consultant functions can vary depending upon a number of variables, consisting of the kind of financial advisor and the client's demands.For instance, independent suggestions is impartial and unrestricted, yet restricted recommendations is limited. A limited advisor needs to declare the nature of the restriction. If it is uncertain, more inquiries can be raised. Conferences with customers to discuss their funds, allocations, needs, earnings, expenses, and prepared goals. best financial advisor brisbane. Giving suitable strategies by evaluating the history, financial information, and abilities of the client.

Assisting customers to apply the monetary strategies. Normal surveillance of the economic portfolio.

If any issues are run into by the monitoring experts, they iron out the source and solve them. Build a financial risk assessment and evaluate the potential effect of the risk. After the conclusion of the threat evaluation version, the consultant will certainly examine the outcomes and supply an ideal remedy that to be applied.

Guided Wealth Management Fundamentals Explained

They will certainly assist in the success of the monetary and employees goals. They take the duty for the supplied choice. As an outcome, clients require not be concerned regarding the decision.

Several steps can be contrasted to determine a qualified and experienced advisor. Usually, experts require to meet basic academic credentials, experiences and accreditation advised by the government.

Always ensure that the advice you receive from a consultant is constantly in your ideal rate of interest. Eventually, financial experts maximize the success of a business and additionally make it grow and thrive.

How Guided Wealth Management can Save You Time, Stress, and Money.

Whether you require somebody to aid you with your tax obligations or supplies, or retirement and estate preparation, or all of the above, you'll locate your answer here. Maintain checking out to discover what the distinction is between a financial consultant vs coordinator. Essentially, any specialist that can assist you handle your money in some fashion can be thought about a financial consultant.

If your goal is to create a program to meet long-lasting economic goals, then you most likely want to enlist the services of a certified economic organizer. You can look for a planner that has a speciality in tax obligations, investments, and retirement or estate planning.

A financial advisor is just a broad term to describe a specialist that can assist you manage your cash. They might broker the sale and purchase of your supplies, take care of financial investments, and assist you produce a comprehensive tax obligation or estate strategy. It is essential to note that a monetary expert ought to hold an AFS license in order to serve the public.

Examine This Report on Guided Wealth Management

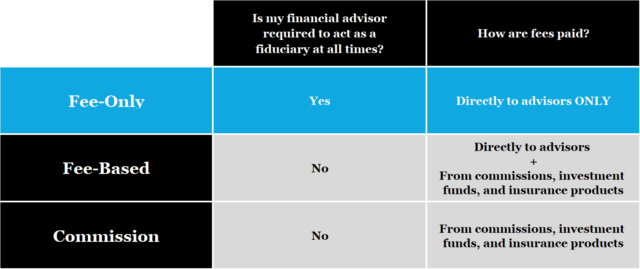

If your financial expert lists their solutions as fee-only, you need to expect a listing of services that they give with a break down of those costs. These experts don't offer any kind of sales-pitch and usually, the solutions are reduced and completely dry and to the point. Fee-based advisors bill an upfront fee and after that earn commission on the economic products you buy from them.

Do a little research initially to be certain the monetary consultant you work with will be able to deal with you in the long-term. The most effective location to begin is to request references from family members, buddies, colleagues, and neighbours that are in a comparable monetary circumstance as you. Do they have a trusted financial expert and exactly how do they like them? Requesting for referrals is a great method to learn more about a monetary consultant prior to you also meet them so you can have a far better idea of how to handle them in advance.

The Best Strategy To Use For Guided Wealth Management

Make your potential expert address these concerns to your complete satisfaction prior to relocating ahead. You may be looking for a specialty expert such as someone that concentrates on separation or insurance policy planning.

A financial expert will certainly aid you with establishing attainable and sensible goals for your future. This could be either beginning an organization, a family, preparing for see this page retired life all of which are very important chapters in life that need mindful consideration. A monetary advisor will certainly take their time to discuss your situation, brief and long term goals and make recommendations that are best for you and/or your household.

A research from Dalbar (2019 ) has actually shown that over 20 years, while the average financial investment return has been around 9%, the average investor was only getting 5%. And the distinction, that 400 basis points each year over two decades, was driven by the timing of the financial investment choices. Handle your portfolio Safeguard your assets estate planning Retirement planning Handle your super Tax investment and management You will be required to take a threat resistance survey to offer your advisor a more clear image to establish your investment asset allocation and choice.

Your expert will certainly check out whether you are a high, tool or reduced risk taker and set up an asset appropriation that fits your danger tolerance and ability based upon the info you have actually supplied. A risky (high return) individual may spend in shares and residential property whereas a low-risk (low return) individual may want to invest in money and term down payments.

See This Report about Guided Wealth Management

Once you involve an economic advisor, you don't have to manage your portfolio. It is essential to have correct insurance coverage policies which can give tranquility of mind for you and your family members.

Having an economic expert can be unbelievably advantageous for lots of people, however it is very important to evaluate the benefits and drawbacks prior to choosing. In this short article, we will check out the benefits and downsides of working with a financial advisor to help you choose if it's the ideal step for you.

Comments on “The Only Guide for Guided Wealth Management”